Invest - Products - Pensions

Build your pension pot through property lending

Invest with Shojin through your pension and enjoy tax benefits. Investors can use their SIPP (Self-Invested Personal Pension) or SSAS (Small Self-Administered Schemes) subject to the requirements of their pension provider.

What are the options with for pension investments?

Increased flexibility to help you save for retirement

Changes in UK regulations have resulted in a relaxation of the rules around pensions - giving individuals more freedom to choose and manage their own investments. With this added flexibility you are able to diversify your pension funds with property investments.

How do pension investments work?

Invest in Shojin projects via your SIPP or SSAS

Pensions offer an effective way to save for retirement as you’ll benefit from tax relief, which should be seen as a long-term savings plan for you to enjoy your retirement. With increased flexibility you can now diversify your funds across different investments and structures to grow your pot as you wish.

Why invest your pension with Shojin?

More control over your pension

How to get started

Six simple steps to use your pension for property investments

Understanding the risks

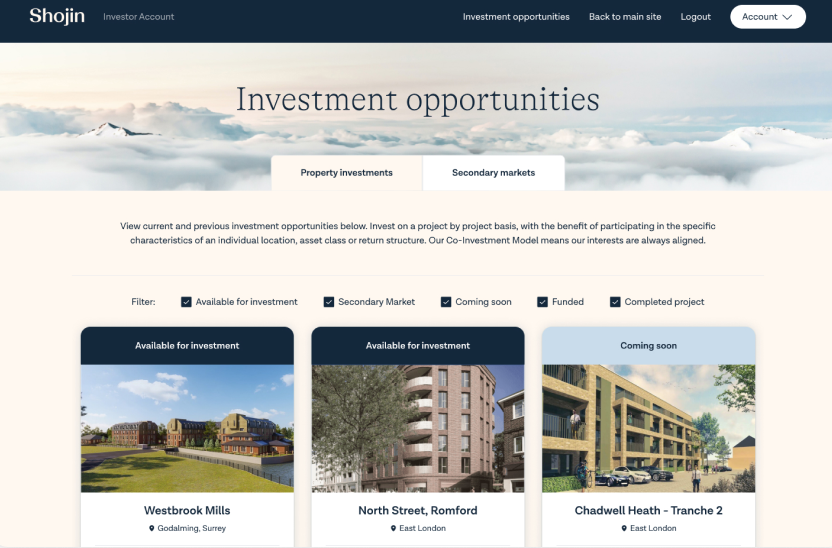

Choosing the project that's right for you

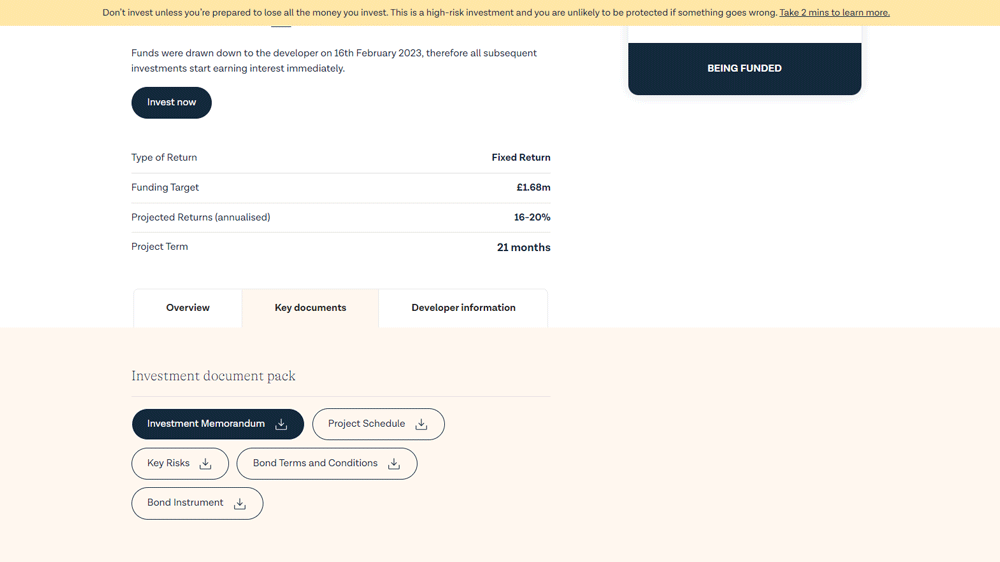

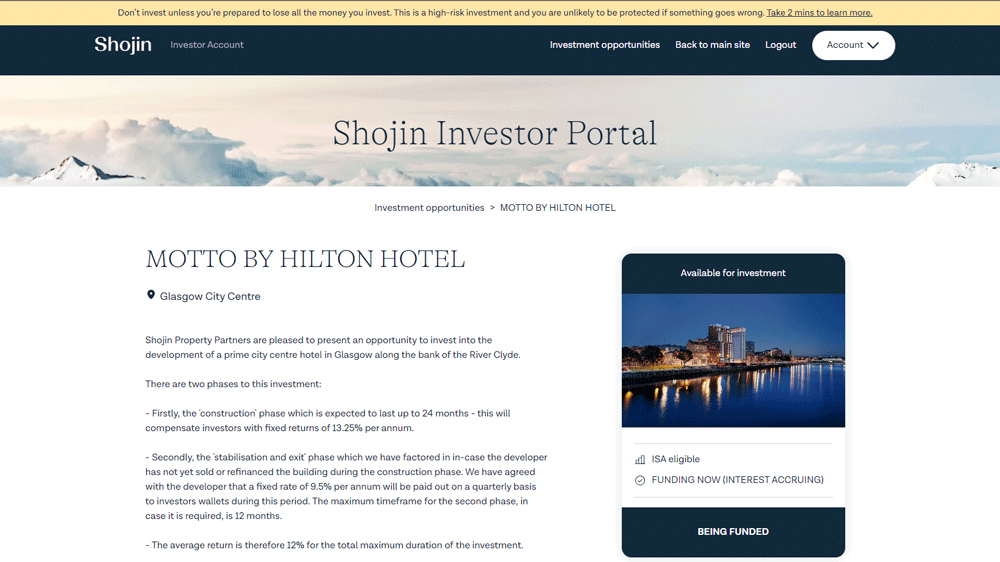

We carry out extensive due diligence on each of the below ares and share this information through the project Investment Memorandum (IM). Choose the opportunity that meets your investment objectives in terms of profile and risk.

Project phase

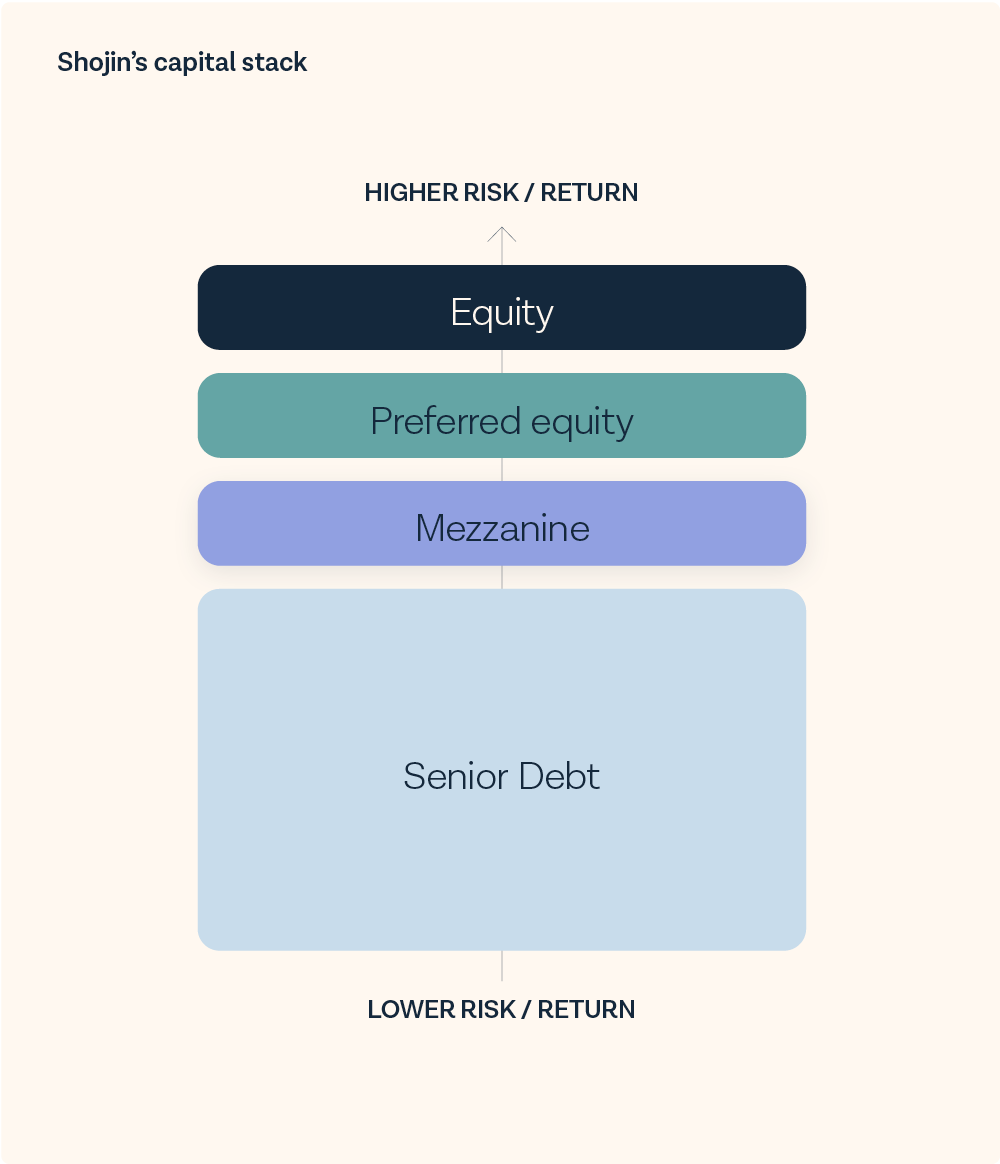

The capital stack represents the layers of funding and the order of repayment. First is the senior debt, then mezzanine, followed by preferred equity and finally equity.

-

Value above and belowThe value that sits below the investor is important because this is the amount that needs to get generated and repaid before the investor. The value above is equally crucial because it represents the cushion that investors have before their returns start getting affected.

-

Key ratiosThe position in the capital stack is indicated by the Loan-to-value (LTV), Loan-to-Gross-Development-Value (LTGDV) and Loan-to-cost (LTC), the higher the ratios the higher the risks.

-

Seniority mattersThe position in the stack becomes relevant if a project is not performing and fails to pay out all the funds, from the bottom of the stack upwards. The higher you rank, the more likely your capital and interest will be affected.

Assessing the suitability of a development in a given location is critical to the success of the project. Physical, economic and cultural factors interact with the development's design and purpose, affecting its viability and attractiveness to potential buyers or tenants.

-

Demographics of potential buyersThe demand for a development is driven by the lifestyle preferences, practical needs, incomes and aspirations of potential residents. Whether located in an urban or rural locale, the development must cater for the requirements of buyers in that area.

-

AmenitiesThe availability, quality and proximity of infrastructure, including transportation networks, schools, shopping facilities and employment opportunities play a vital role in determining a development's desirability.

-

Physical characteristicsThe geography of a location, such as terrain, climate, and proximity to natural resources, can impact project feasibility and execution. Extreme weather conditions, geological instability, or environmental regulations can lead to delays, increased costs, or even project abandonment.

To protect investors from individual project risks, protection mechanisms are put in place to secure investors from scenarios that put their investments at risk. They incentivise the developer to repay funds for investors to exit the projects.

-

Charges held with land registryA charge is the means by which lenders enforce their rights to property. A first charge entitles the lender repossess and sell the asset to recoup funds first, followed by a second charge which is paid out after the senior lender in priority over the developer’s equity.

-

Personal guaranteesBorrowers may be asked to provide personal guarantees to make them legally liable to repay the loan. Whilst this is a legitimate way to add further security, it is also a way to keep the borrower focussed on repaying the loan especially if the scheme runs into trouble.

-

Additional securityThis may include cost overrun guarantees, debentures or cross-collateralisation across other assets the developer owns, which in the event of a default, can be repossessed and sold.

The complexity of a construction project impacts the level of risk for investors. This is driven by a combination of factors including intricacy of design, engineering requirements, execution, and management required to successfully complete the project. Fixed-cost contracts and professional advice from surveyors is typically required to manage these risks.

-

Scale of the buildLarger intricate projects, such as high-rise buildings or sprawling housing developments, tend to be more complex due to the increased scope, logistics, and coordination involved. They typically require structural elements that demand careful engineering and construction expertise.

-

Nature of the siteChallenging site conditions, such as irregular terrain, poor soil quality, or tight spaces with reduced access, can complicate construction logistics and impact foundation and site preparation.

-

Architectural design and permissionsUnique, innovative, or intricate architectural designs can lead to complexity in construction, requiring specialised skills, materials, and precision. Likewise, planning conditions dictate specific delivery requirements and adherence to compliance.

Project phase

The stage at which investors come into the project determines the level of risk. Generally, the earlier the investors come into a development project, the more risk they take on as there are more milestones for the developer to hit. There are several categories of phase that should be considered.

-

Planning statusA development project with no planning permission is ultimately a speculative play as it may take longer than expected, or in some cases never come through at all. Whilst if full consented planning or permitted development rights (office to residential conversions) are in place, you know what is being built and the associated value of this.

-

Type of developmentFull construction, conversion or renovation projects all have different levels of risk. If the structure of the building is already existent there are no associated costs uncertainties. Conversion and renovations are simpler to deliver which reduce time and cost risk.

-

Status of developmentDevelopments take time; there are many items which influence costs and timelines. Coming in at an earlier stage means that tendering, site ramp-up and preliminaries are required which present cost uncertainty. The closer you are to construction completion, costs are determined and it become more about realising the value.

In order to get repaid and exit a project the value needs to get realised to release cash. This can take the form of the sale of the units or the refinancing of the block in its entirety.

-

Selling individual unitsSelling units is dependent on demand, attractiveness and local competition from similar units in the area. Sales and marketing strategies need to be executed to encourage pre-sales ahead of construction completion and bulk sales to reduce risk.

-

Refinancing to release fundsAnother option available to developers to repay investors is to refinance the entire finished block. A completed development commands a higher value than previously, against which a loan can be raised to repay investors. If the value is sufficient, this is likely a quicker solution than individual sales.

-

Occupancy for asset investmentsFor income-generating assets such as student accommodation blocks that depend on occupants, pre-secure locked in tenancies reduce risks. Likewise for commercial assets, established tenants with strong covenants provide stable cashflows which reduce the risks.

A developer’s track record dictates their suitability to take on and deliver a given project. Their team, their financial credentials, capacity and trustworthiness all impact risk.

-

Previous developmentsPast performance is used to assess their ability to handle potential challenges and mitigate risks. Similarly, their reputation can influence the market's perception of the quality and value to attract buyers.

-

Contractor and supplier relationsEstablished developers often have built relationships and with reliable contractors and suppliers, and have a strong professional team working for them, reducing the risk of delays or disruptions due to poor workmanship, material shortages or technical failures. Additionally, they need to have the capability to deal with situations where subcontractors and suppliers underperform or go out of business.

-

Financial standingA developer’s credit history is an indicator of how their previous developments have performed. Their asset and liabilities statements indicate previous success and ability to cashflow construction between drawdowns, provide personal guarantees and cross collateralise across their other assets to reduce the risks for investors.

Time plays a critical role in property development and has a significant impact on the associated risks. It is usually time, rather than cost, that affects a project’s success and profitability.

-

Market fluctuationsThe longer a project takes to complete, the more susceptible it is to shifts in market conditions and inflation. Changes in housing demand, housing prices, material and labour costs and economic factors can affect the project's viability and potential returns.

-

Financing costsExtended project timelines lead to increased financing costs in the form of interest payments. Whilst this might not impact a senior lender’s position, this does reduce the cushion for those further down the repayment chain. Equally, changes in interest rates overtime can increase overall project costs.

-

External factorsOve over a prolonged development period, geopolitical events, economic recessions, and unforeseen global disruptions can impact a project's risk profile.

Take your investments

to the next level.

Sign up for access to our expertly selected investment opportunities. Build your diversified property portfolio today.