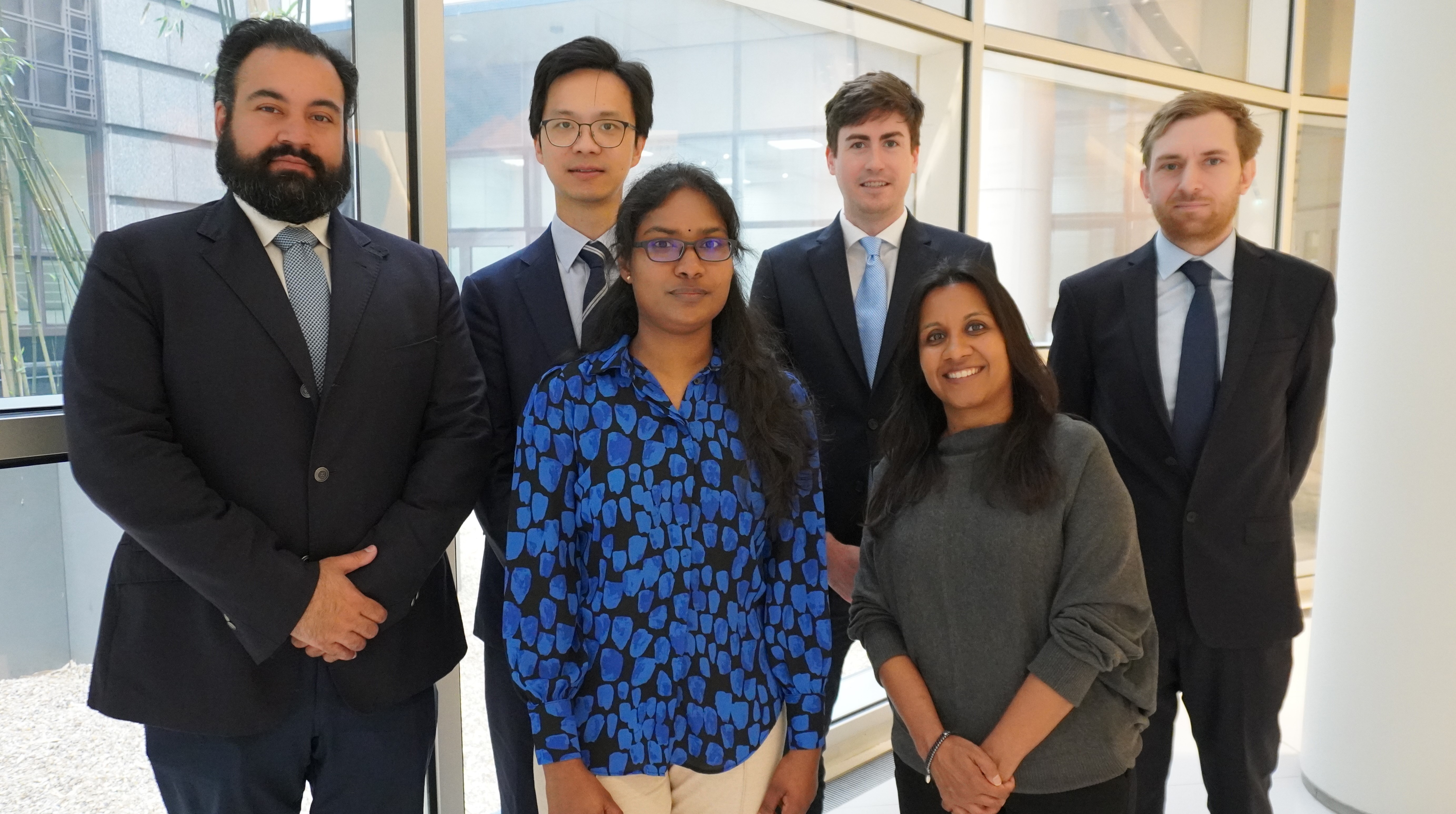

In the fast-paced world of real estate investment, Shojin proudly welcomes several new joiners, each bringing their unique expertise and passion to our global mission. These recent additions to our team symbolize our international growth, as we strive to make real estate investment accessible to all.

Jacky Chan is a seasoned finance professional with 15 years of global real estate experience. He has advised investors in over US$4bn of transactions over his career across both private and public capital markets. Prior to joining Shojin, he was Head of Real Estate at an investment bank, having also previously worked for Morgan Stanley, Deutsche Bank, a major HK family office and a private equity firm. His experience spans across UK, Canada and HK/China. While at Morgan Stanley, he was ranked as a Runner-Up by the Institutional Investor All-Asia Property Research rankings. Jacky’s role in Shojin is to help investors better understand the risk and returns of Shojin's investment products. He also works closely with Shojin's Family Office and Institutional Investor clients, assisting them in their real estate investments.

Kirat Dhillon is responsible for managing Private Clients. With over 10 years of experience on both the buy-side and sell-side with experience in origination, research, structuring, capital raising. He has dealt with highly complex and credit intensive deal across the US, UK, Europe and Asia. He joins with long standing relationships with family offices, private equity firms and alternative asset managers. Responsible for raising capital from Shojin's family office, institutional investor clients, banks and non-bank lenders.

Thanuja Yogarajan’s career started with 4 years of experience as an Assistant Management Accountant in the retail, hospitality & construction industry. Additionally, she is a CIMA passed finalist, with experience in monthly accounts preparation, budgeting, variance analysis & KPI analysis. Her role at Shojin covers monthly accounts preparation, alongside adding her expertise into the daily finance and investor reporting, as well as the audit pack preparation.

Hugo Smyly has joined as Associate Director, Investor Relations. Hugo has over 10 years of experience in direct lending, with notable experience in onboarding and managing individual and corporate investors and portfolio management. Hugo will utilise his prior experience to grow the investor base and evolve the management of Shojin’s investor networks globally.

James Hall will lead the newly formed Portfolio Management team. With over 11 years of experience, James brings a wealth of expertise, having held prominent roles throughout the real estate industry, including: mortgage banking, investment sales, portfolio management, and operations. James will focus on digitizing the lending functions, report automation, process optimization, and bringing efficiencies across the organization.

Meenal Shah is also a new Shojin recruit, following a long corporate career as a results-driven strategic retail planner spanning over 14 years, and working within fast paced fashion retailers in both the US as well as UK including Debenhams, Foot Locker, J Crew and Gap. She took a career break to raise a young family. She then transitioned back to work just over two years ago through a Returner Program with Amazon. Following this she decided it was time for a career change, joining a blood cancer charity as an EA to the CEO. Her role at Shojin is to provide support to the CEO at an exciting time in Shojin’s journey.

Jatin Ondhia, CEO of Shojin, said: “We’re delighted to welcome Kirat, Jacky, Thanuja, Hugo, Meenal and James to the Shojin team. They have already had a fundamental impact on the business since recently joining in their respective roles, helping Shojin to expand in all directions as we continue to pursue ambitious growth targets in the months and years to come following our Series B raise.”

“This is an exciting time of Growth and internationalisation for Shojin. The added skills and expertise of our new key hires will add great depth to our offering, helping us reach our vision of making real estate investment accessible to everyone.”