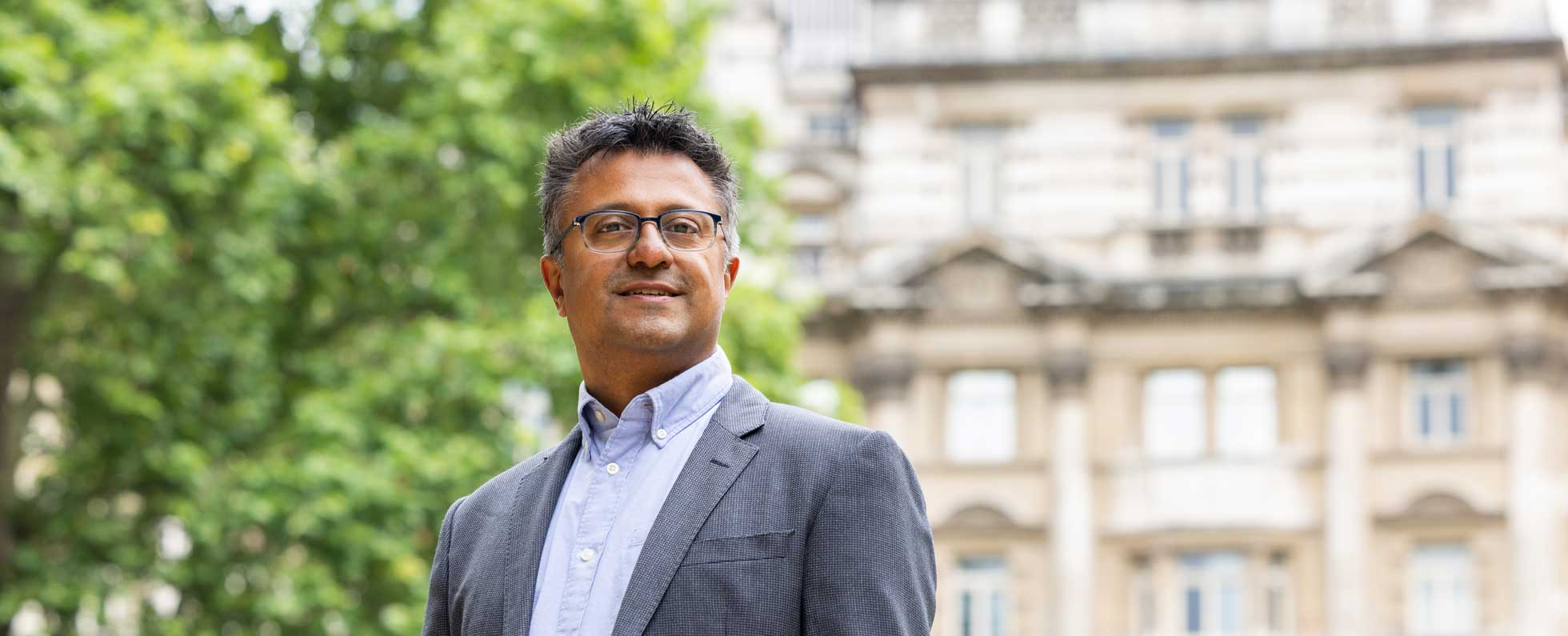

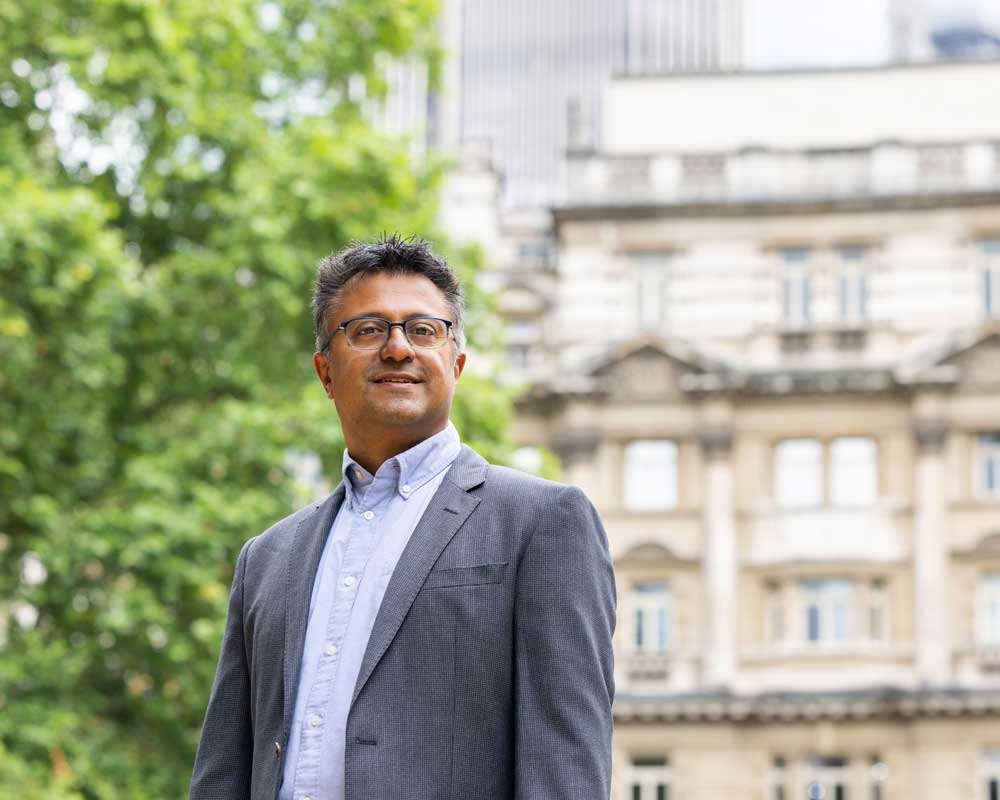

The biggest problem for individual property investors is finding good real estate projects to invest in, and that is the challenge Shojin has since 2009 been working energetically to address, according to Jatin Ondhia, Shojin’s Co-Founder and CEO.

Shojin was established in 2009 to target HNW and family office type clients from amidst the wealth management community, and since 2017 has also operated a UK FCA-regulated online real estate investment platform that aims to democratise access to investors across the globe seeking institutional-grade, mostly UK-based real estate investment opportunities.

To date, Shojin has raised over £34m to fund over £200m worth of real estate development across twenty-nine projects, and with plenty more in the pipeline, including international deals as well. Hubbis met with Jatin recently to learn more about Shojin’s concepts and offerings, and why the focus is still mostly on what he sees as a remarkably robust market for UK-based property assets. He also explains the proposition for HNW and UHNW type investors, and how Shojin is expanding its range of products from equity and mezzanine funding into the senior funding tranche, particularly for family offices. He also elaborates on why and how Shojin is democratising access to new residential sector projects.

Finally, he explains why Asia is so important to the business, accounting as it does already for some 35 per cent of the firm’s active clientele.

Jatin has over 17 years’ experience within the capital markets and the property sector. He worked as an investment banker at UBS for 12 years in credit sales within their quantitative risk and performance optimisation business. Having always invested in real estate on the side, he then started Shojin in 2009 after recognising that there was a huge opportunity to bring a broader market of investors into lucrative property deals to which they would not otherwise have access.

A truly professional service

“Shojin sifts through the deals to find the right opportunities for our clients,” he reports. “Investors are so often bombarded by brokers who carry out little or no due diligence, whereas we specialise in identifying and delivering suitable opportunities, but only after conducting thorough due diligence on each project. Our approach saves investors considerable time as well as enabling greater diversification, and this has been instrumental in cementing many relationships between Shojin and repeat investors.”

He explains that Shojin receives around eighty opportunities each month which they first trim down after an initial screening that eliminates some 90% of those ideas. The team then selects perhaps one to three projects for detailed due diligence and committee sign-off, before negotiating terms with the developer.

Deeply analytical

Jatin reports that Shojin, over the years, has become a genuine expert in the field. “We analyse each property opportunity on our short list from over 200 angles and aspects, before any such project makes the final cut, so we are far more comprehensive in our research than even the typical senior lenders are. Shojin stands as the first loss holder along with the developer in these deals, so we really get hurt if anything goes wrong, and that is why we are so intensely analytical and why we have devised our own multistage due diligence process.”

He says the firm tends to conduct detailed due diligence on around eight projects per month, all of which are usually projects in what he calls the ‘sweet spot’ for Shojin clients. These are projects with an end value of between £10 million and £50 million, which are the types of deals too small for institutions, but too large for individuals. He says typical projects might include residential, student accommodation, Private Rented Sector (PRS), and specialised senior living properties, almost exclusively to date in the UK.

Expanding the proposition

Jatin explains that he founded Shojin in 2009 and then launched the online platform in 2017 to enable fractional investing in real estate developments while providing developers with a consistent and trusted source of finance.

“Increasing taxes and legislation over the years has led many real estate investors in the UK to seek alternative ways of driving returns in the property market,” he reports. “By identifying attractive opportunities backed by the highest levels of due diligence, Shojin offers investors an alternative way to invest in construction projects as well as long term bricks and mortar investments – striving to deliver returns superior to those available elsewhere in the market. Typically, such institutional-grade property deals are only accessible to the top 1% of the world’s population but the online platform enables global investors to access this market from as little as £5,000 per investment. Larger investors and family offices act as anchor investors in such deals.

Shojin’s stamp of approval

Shojin prides itself on its unique co-investment model, creating a clear alignment of interest. He explains that the developer and Shojin invest in the pure equity - the first loss position in the capital structure - while Shojin sells preferred equity and mezzanine finance to external clients. He reports that the investments are structured to provide returns of between 14% to 25% annualised to investors, depending on the position in the stack, over 12 to 36 months.

“As this portion of the capital structure sits above the developer and Shojin equity, we are effectively providing a layer of additional security for our clients but also delivering significant returns,” Jatin elucidates. “And as we are ultimately taking the lowest capital position in the structure, we are totally exposed, and we only take our returns when investors have been paid, so the investors gain great comfort from us putting out money where our mouth is, so to speak.”

From little acorns…

Jatin offers more colour on his investment banking career with UBS in London and New York, and motivations for founding Shojin. He explains that during his UBS years, he and his business partner, Sandeep Puri, invested extensively in property.

“It is in our Indian blood really,” he says. “During those years, we both built up lucrative portfolios for ourselves, buying rental properties. It was certainly not rocket science, but we both realised that most professionals and even wealthy investors were not tapping into the lucrative mid-market real estate space. More importantly, investors were unable to properly evaluate opportunities that they might come across, leading to poor decision making.”

He recalls that friends and acquaintances saw what they were doing and asked to join in, so Jatin and Sandeep packaged co-investments for them supported by easily understandable proposals.

“By the stage that we invited these other investors in, we were already going to do the projects anyway, so they had great comfort in knowing we were going in,” he explains. “And we said we won't make any money until the investors do, in other words we would share profits at the end.”

Seeing the true potential

Jatin reports that what he and Sandeep then soon realised is that in the mid-market property development space, principals soon want to do larger projects that they, friends and family cannot fund, so they want access to a broader and deeper investor base. “The developer might have started with a few apartments, then perhaps scaled up to fifty, and then 100. At that level and based on the typical 60% bank funding, the other 40% was still too small for institutions, but too big usually for friends and family members, and that is the sweet spot in which we operate, as there is a significant funding and expertise gap to be filled.”

He says that Shojin has expanded apace and today counts investor clients from roughly forty countries, with some 35% of those from Asia. Globally, Shojin has offices in Hong Kong, East Africa, and partnerships in the UAE, India, and Israel, with others launching this year. Primarily these local offices and partnerships are geared towards inward investment to the UK market but the intention is that, over time, each of these offices will locally originate projects for Shojin’s platform.

Professionalising the funding

He explains that as the years roll on, most of the smaller and mid-sized developers remain very good at developing but weak at structuring deals. “These types of smaller developers usually don’t know how to devise the best structures, or who to approach and how to present deals properly,” he says. “And that is again where we come in; we are experts in structuring the right package.”

He says that in the mid-market they focus on, returns are generally healthy, as competition is generally less fierce than in both the smaller project segment and the mega project segment. Shojin’s sweet spot is funding deals worth between £10m and £50m.

Minding the gap

“In this middle ground, the funding gap that Shojin and our clients cover allows us all to participate in deals that end up producing very good returns,” he reports. “It was a natural step for us to transition the model from wealthy investors only that were putting up several hundred thousand pounds per investment to a global market, where buyers could put in anything from £5,000 or above, and that is why we created the online platform, which we launched in 2017 with FCA regulation.”

He clarifies that Shojin today continues to offer investment packages to both the upper segments of investors and to smaller investors online. “We still work closely with many HNWIs and family offices and others who want to invest significant sums but who do not have the skills or capacity to analyse and filter deals, and at the same time since 2017 we have been expanding our penetration of smaller investors through the online platforms. Both types of investors can diversify across multiple projects.”

The next phases of expansion

Shojin has been evolving its offering, not just by expanding beyond wealthier buyers to smaller investors, but also to package investments across the capital structure of the deals, and even to acquire the end project from the developers. “For example,” he reports, “it is sometimes a logical next step for Shojin to selectively be the acquiror of some of these projects once developed. There is a substantial and growing ‘built-to-rent’ segment of the UK apartment markets, and investors increasingly want to be owners of those yielding assets as a long-term investment.”

Additionally, as Shojin has the due diligence and structuring expertise, he says they will increasingly look at selling senior funding to bigger investors such as family offices.

“We are already making significant additional fees on these types of deals, as we have clients who want to take senior funding exposure, and we price our upfront and carry fees at appealing levels compared with the competition,” he says, adding that this senior/bridge funding produces returns of around 8% to 12% annualised over 12 to 36 months and with first charge on the assets. “And we also sometimes structure in and sell debt subordinated to the senior finance, secured by a second charge and producing target returns of 15% to 20% annually,” he remarks.

And Jatin reports that there are further logical steps to make in terms of their core offerings. For example, the Shojin offering thus far is not in the form of a formalised fund structure, but the next step is to launch a Jersey-incorporated fund later this year. “We will do the first fund in Jersey, but we are looking at other jurisdictions as well,” he explains. “Our investors will then be able to buy into a diversified set of projects through one regulated vehicle.”

Working with the wealth community

He also expands on the distribution and marketing, explaining that they today have multiple approaches, ranging from the online platform to more individualised promotion to the wealth management community. He says they work mostly with the independent wealth community, those that have clients who are wealthy professionals and business owner types, citing St James’s Place as a good example.

“These independent wealth managers are free to seek the best selection of deals from different parties,” he says. “They are not beholden to the limitations imposed by many of the major private banks, and they also seldom have strong real estate offerings, so we solve these issues for their clients, and hence they are willing to open the doors to engage with their clients and promote these deals. And they make fees from us in the process, of course.”

Word of mouth is also a major source of clients, and he says Shojin speaks directly to organisations such as family offices, including inviting them to small marketing and educational events they hold. “With some of these family offices, we are helping them build diversified portfolios of these investments with different timeframes, for example several deals of £3 million rather than one £20 million deal, and they are increasingly warming to this approach,” he elaborates.

The UK as the core focus

Jatin also clarifies that although Shojin has recently invested in its first non-UK project in Penang, Malaysia, the firm remains very UK-centric in terms of the assets they want to be involved with.

“The UK is experiencing a severe shortage of housing, and a significant imbalance in supply and demand,” he explains. “For the last probably 15-20 years, we have not been building enough homes, and every year, half a million students come out from our UK universities, with some 10% of those, or more, soon wanting to get on the housing ladder, meaning that there is a constantly growing shortage. And every government faces the same issue of losing potentially safe seats in parliament if they threaten to open up easier planning permissions. The reality is nobody wants more apartments or houses to be built in their own areas. This is the ‘NIMBY’ dilemma – not in my back yard. This will therefore continue to support house prices.”

He explains that Shojin’s focus is on the lower to mid-market for apartments costing between £300,000 and £600,000, and in good economic catchment areas in and around cities, towns and in general UK suburbia, as well as in the much-in-demand coastal towns of the UK. He cites, for example, a new development of apartments in Birmingham, the UK’s second largest city, costing between £400,000 and £500,000.

Support from all quarters

“Successive governments tend to also support this segment, with a variety of fiscal and funding schemes,” he says. “Ostensibly, they are trying to help younger people, but of course it is also to win more votes.”

Accordingly, Shojin focuses on that segment, along with specialist or quasi-residential properties, such as purpose-built student accommodation, built-to-rent projects, or senior living facilities. “The UK is actually moving towards more of a rental model, which has been prevailing in places like Europe, and in the US for many years,” he reports.

He says this is because more people than ever before cannot afford to buy due to elevated prices and rising rates, and younger people like the social mobility of renting, taking on different properties at different stages as they study, then work, then move in with a partner, then have a family, and so forth. “And the rental market in the UK is remarkably strong, with rents having risen significantly in recent years, and with upward pricing pressure continuing today,” he states.

Huge potential remains

That is why he sees such huge potential in purpose-built student accommodation and built-to-rent developments, including specialist properties for retired and senior people whose needs evolve, but whose needs are not as yet being addressed, they are still rattling around in their large family homes. “Take the US, for example, they have numerous complete retirement villages and communities across the nation,” he says.

His final observation on the UK market is that with Brexit having taken place, the government needs to replace plentiful lower cost labour with a higher grade, skills-based workforce, hence the continuing emphasis on the financial sector but a massive new effort to drive other key sectors such as software, technology, FinTech, healthcare technology and so forth. These attract more expensive talent and there is a drive to diversify investment across the country, not just in London or a few other places for the financial sector.

Key priorities

Jatin zooms in on Asia as a key priority market for garnering investors, noting that today some 35% of the Shojin investor base is from the region, partly because of the long-standing connectivity between the UK and countries such as Singapore, Hong Kong, Malaysia, and others. “Actually, we have this far been very focused on Hong Kong to date, but there is huge potential for us in Singapore and beyond,” he reports.

Another priority is to expand the Shojin offerings, to include the new and diversified funds he had mentioned earlier, and proposals for investors to participate in distinct parts of the capital structure.

“And the third mission is to seek out other international opportunities, similar to the Penang deal we sold to investors recently,” he reports. The Malaysian investment saw Shojin raise over £850,000 from more than forty global investors as an initial deposit to acquire 20 apartments within Muze, the first residential phase of the multi-billion Ringgit Penang International Commercial City (PICC), a ground-breaking smart city development by leading Malaysian developer Hunza Properties Group.

“Among its numerous accolades, Penang is the biggest single draw for Malaysia’s inward foreign investment and is a huge tech and microchip centre rated as Asia’s Next Silicon Valley by the BBC,” he reports. “Moreover, the island is rated one of the best retirement destinations globally, as well as being a great medical tourism centre, all of which gave us the great confidence we needed to invest,” Jatin reports.

He says the firm already has some interesting conversations going on in Asia. “We did well with the Penang deal, and we now have some interesting and significant potential partnerships out there and in Asia in the foreseeable future,” he reports.

Shojin the disruptor

Jatin closes the discussion by noting that he loves quiet time at home reading once his two young sons have gone to bed. “I recently read Simon Sinek’s ‘Start with Why,’ which is all about the motivation for starting and running businesses, and it was rather illuminating,” he says. “Essentially, the book helped confirm my view that Shojin can be seen as a real estate market disruptor, opening the doors to more alternative assets to a wider array of investors. We are pioneers, and we will keep disrupting in this market and thereby elevating the proposition for the developers and for our investors.”