Maximize ISA benefits by April 5th and explore tax-efficient savings strategies and investments.

The end of the tax year is fast approaching, and investors are accordingly even more eager than usual to make sure they are making the best use of their annual tax-free savings allowance. The UK tax year ends on the 5th of April; investors wanting to enjoy tax-free gains on their investments in the years ahead need to have their cash allocated by this deadline. One of the most tax-efficient ways to see your hard-earned savings grow over time is to put them into an Individual Savings Account, more commonly known as an ISA.

These accounts have one major advantage over other saving accounts – they allow you to receive tax-free interest payments on the cash invested within them. This article serves as a primer on why ISAs are such a great way to save and invest in a tax-efficient way, as well as covering the main questions investors will be asking themselves at this important time of the year about which type of ISA might suit them best.

What is an ISA?

Since their introduction back in 1999, ISAs have dramatically ballooned in popularity and have gone on to become an essential tool for everyone who takes responsibility for their personal finances. This is because these accounts benefit from a highly favourable tax status which makes them the best option for most savers. Essentially, savers pay into an ISA from their earnings after tax, but once inside the ISA these funds are then protected from income tax or capital gains.

This means that by holding investments within an ISA, you can legally avoid taxes on both the income the investment generates, as well as taxes that would have been due on any increase in the value of the investment itself. Even better still, no tax is payable on any money withdrawn from the account, and there is no restriction on when or how much money can be withdrawn.

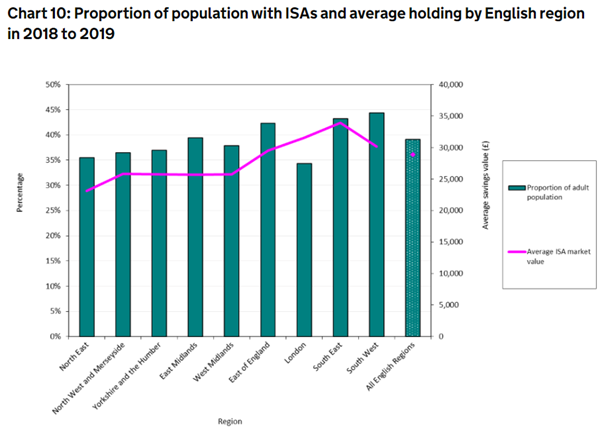

The ubiquitous and well-deserved popularity of the ISA is revealed by recent research by HM Revenue and Customs. As the chart below shows, nearly 40% of the British population hold at least one ISA, with an average savings value of around £30,000 contained within.

If anything, this figure is slightly lower than could be expected given the tremendous advantages of the ISA outlined above, but even in an economy as financially literate as the UK, not everyone chooses to take advantage of the tax breaks on offer.

There is one drawback to the ISA however, and that is that the tax-efficient nature of the scheme means that the government enforces a £20,000 annual limit to how much cash can be paid into ISAs. Hence the supreme importance of the looming tax year deadline – if you don’t use your annual allowance of £20,000 before the 5th of April, you will have lost the chance to do so for the 2021/2022 year! The allowance does not ‘roll over’, and once the deadline passes you will have lost the chance to invest up to £20,000 tax-free.

How do you become an ‘ISA millionaire’?

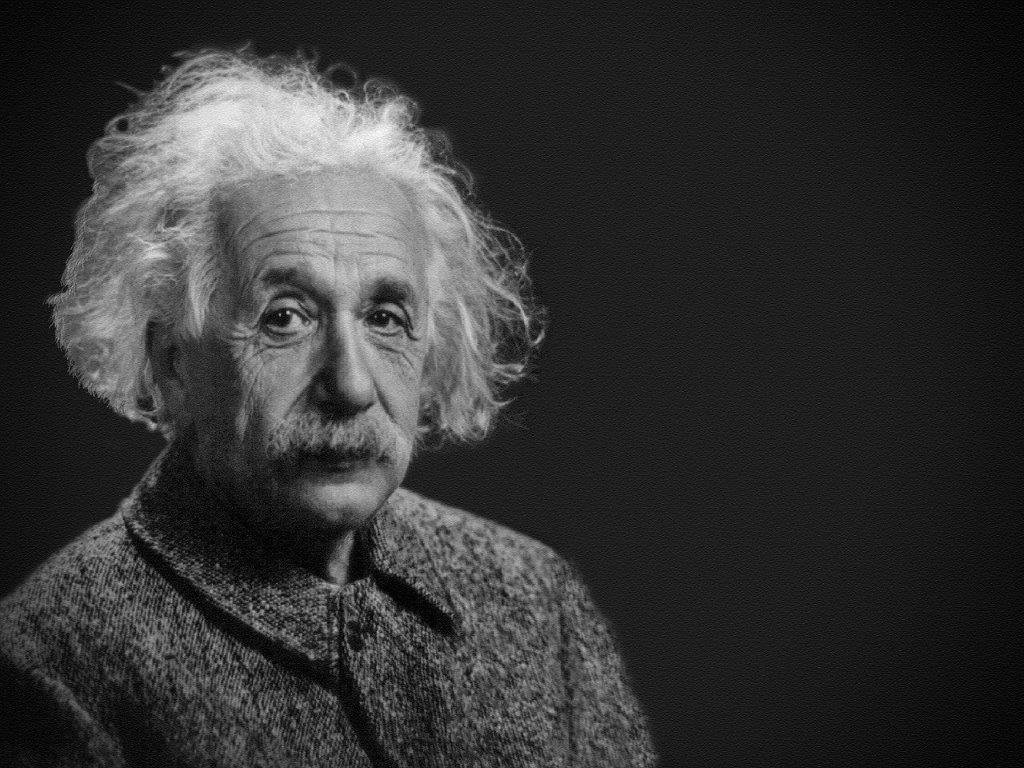

A well-known, although possibly apocryphal tale, has Albert Einstein replying to the question, ‘What is mankind’s greatest invention?’, with two simple words: ‘Compound interest’. Whether or not this conversation actually happened is irrelevant – the wisdom contained in Einstein’s supposed answer is genuinely timeless! If you keep re-investing your interest payments into the underlying investment, the compounded rate of growth will bring you much higher returns than would have been possible if you kept withdrawing and spending your interest payments. ![]()

ISAs can be considered simply as ‘wrappers’ or ‘containers’ for investments, similar to other forms of account offered by banks and brokerages. What makes the ISA stand out is that it is such an effective wrapper within which to hold your investments from the point of view that they allow you to minimise your tax burden and they allow you to take advantage of the fantastic possibilities of compounding.

ISAs can be considered simply as ‘wrappers’ or ‘containers’ for investments, similar to other forms of account offered by banks and brokerages. What makes the ISA stand out is that it is such an effective wrapper within which to hold your investments from the point of view that they allow you to minimise your tax burden and they allow you to take advantage of the fantastic possibilities of compounding.

To give a simple example, £20,000 invested at a rate of 10% per annum would allow you to receive, if you so wished, an annual income of £2,000 from your investment. Whilst this would be a welcome flow of passive income, it certainly isn’t a life-changing amount. However, if you chose to leave that £2,000 in your ISA and reinvest it, you would be a millionaire in approximately just 20 years, assuming a similar rate of return over the whole period.

The current estimates are that the UK has around 2,000 so-called ‘ISA millionaires’, by which is meant ordinary savers who simply kept reinvesting their interest payments and let the miracle of compounding do the rest. If you can invest your £20,000 annual allowance before the 5th of April deadline, then you can simply sit back and watch the value rise, safe in the knowledge that you are protected from capital gains tax due to your savvy use of the ISA as a tax-efficient ‘wrapper’.

What is an Innovative Finance ISA?

There are four types of ISA, each with a different purpose and target audience.

A cash ISA is the closest one to a traditional savings account and will offer an interest rate closely correlated to the base rate set by the Bank of England. Currently this is 0.5%, and with interest rates as low as this even the miracle of compounding is still going to need many, many decades before a reasonable return has been generated.

Stocks & shares ISAs allow savers to hold equities and other conventional forms of investment within an ISA. These accounts suit investors who are happy to manage their own money and are willing to tolerate the large swings in valuation that punctuate the stock markets’ progress.

Then there is a lifetime ISA, which is similar to a pension and has much stricter restrictions on how much can be paid in and when it can be withdrawn.

Finally, there are innovative finance ISAs (IFISAs). These seek to allow ordinary savers access to superior returns than can be generated by any of the above types. They do this, as the name suggests, by allowing more dynamic and innovative forms of finance to be contained within the ISA wrapper than was possible previously.

One of the most significant improvements to the financial landscape of recent years has been the rise of peer-to-peer lending. This is when entrepreneurs or established companies who have a specific investment proposition are matched up directly with savers who are willing to lend in search of a market-beating rate of return. The key advantage of this approach is that by cutting out banks, who are the traditional middlemen acting to bring borrowers and lenders together, costs for both sides of the business deal fall, and accordingly higher rates of return can be earned.

Average returns on IFISAs have now been above 9% for the past two consecutive years, and it is this track record of healthy returns that has served to make IFISAs one of the fastest growing sections of the overall ISA market.

Introducing the Shojin IFISA

The Shojin IFISA allows you to unlock the full potential of your £20,000 annual ISA allowance. Through our ‘in-house’ IFISA you can invest in a wide range of real estate projects both in the UK, which are listed on our investment portal. We extensively vet all the projects we propose to our clients, and following our unique co-investment model we invest our own money alongside you. We do this because we believe our market-leading research and analysis teams can discern which are the best projects out there, and we see ourselves as partners with our clients. We benefit most when our clients see a strong return on their investments.

Importantly, once cash has been committed to an ISA, as well as being withdrawable it can also be transferred directly into a new ISA. If you are convinced of the need to diversify your portfolio to minimise the damage that rising inflation is doing to your returns, there are no better options available than real estate. You are able to transfer any existing ISAs and invest up to £20,000 in the last months of the 2021/22 tax year into Shojin’s IFISA and benefit from tax savings on any returns you receive.

Setting up an IFISA through our online platform is quick, simple, and best of all free.

Opening an account takes a matter of minutes, and our user-friendly interface combined with support from our customer service representatives makes the experience clear and easy.

You can invest from as little as £5,000 into Shojin’s real estate projects, but you need to act before the deadline of April, 5th.

Open an account today, and start your journey towards becoming an ISA millionaire.

Join us today by registering at www.shojin.co.uk/ifisa