It is often noted that Economics doesn’t have ‘classics’ that each generation of experts return to and read and re-read.

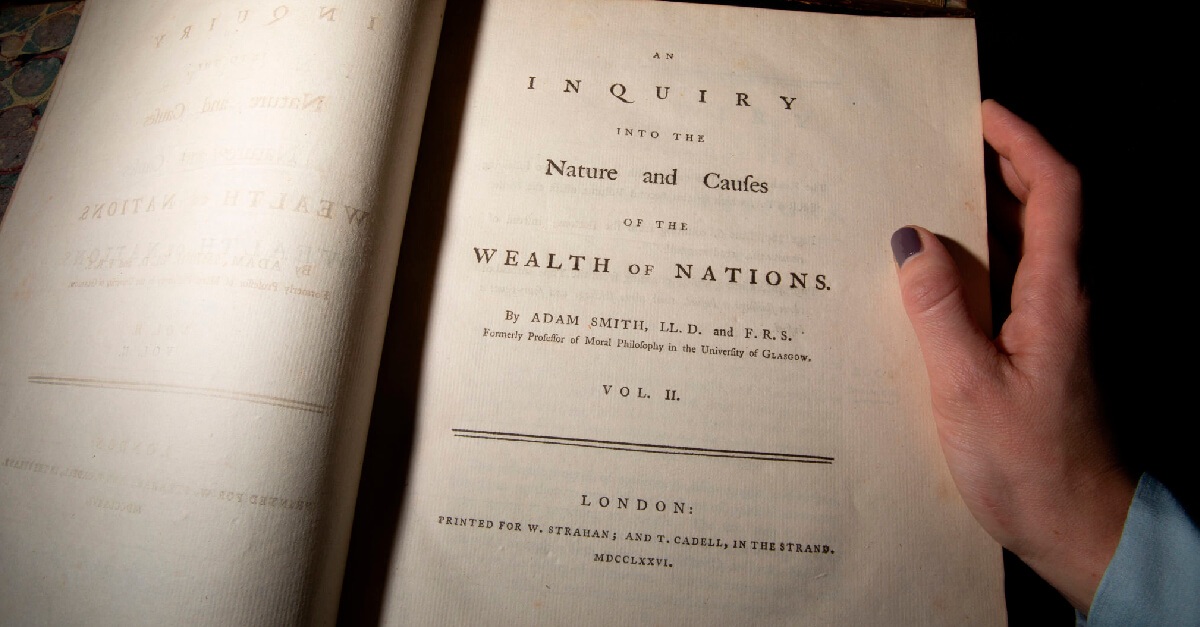

For example, everyone – be they economist or layman – has heard of Adam Smith’s The Wealth of Nations, but hardly anyone has actually read it.

Is this a problem? Possibly not.

The key point is that economics and economic analysis moves ahead in such a way that the revolutionary ideas of the past are absorbed into present knowledge and subsequently refined in such a way that makes reading the original version interesting but purely optional.

Competition drives better outcomes for consumers

One such foundational idea the world has Adam Smith to thank for is the fundamental concept at the base of most modern economics; the idea that competition between businesses is almost always preferable to monopoly from the consumer's point of view.

This is because it is competition and the resulting need to offer some combination of a good quality product at a reasonable price that has driven better outcomes for consumers across the economy.

However, the level of competition from one sector to another can vary dramatically, as well as the nature and tone of this competition. The purpose of this article is to outline how we here at Shojin see the landscape of the online real estate investment space today, and, more importantly, what we expect it to look like in the near future.

Competition or collaboration?

Obviously the view of competition outlined above is highly simplistic, and any economist trained in the last decade or so since the Global Financial Crisis would question some aspect of this view.

There is much more to B2B and B2C interactions than the simplified ‘fairy-tale’ where competition automatically solves all economic woes in a frictionless manner might lead us to believe.

Part of what makes our mission here at Shojin so exciting is the fact that we are confident in our investment offering, and are therefore happy to stand next to, be compared with, and compete against other investment platforms.

However, there is also a healthy dose of collaboration in terms of how we operate, and that is good for our customers for two main reasons.

1. Firstly, collaboration means we can bring to our clients a wider range of real estate investment opportunities. By partnering with like-minded platforms around the world we can unlock investment options in many more diverse locations.

2. Secondly, collaboration is a signal that a nascent and innovative marketplace is maturing into a permanent feature of the global investment landscape. Crucially, the rise of collaboration in this space shows that there is no longer a debate over whether online real estate investment platforms can succeed anymore; the debate has now moved on to the more important question of how the sector can best represent itself within the global investment management world.

As such, there is now a dynamic of internal competition between different approaches to online real estate investment, at the same time as there is collaboration in order to raise the profile of the sector and to bring the potential benefits of real estate investment to as many clients as possible.

Introducing the AREIP

Shojin is a proud founding member of the Association of Real Estate Investment Platforms , an organisation that brings together real estate investment platforms from around the world to advance the interests of the sector as a whole.

Specifically, the AREIP is set to play a vital role by bringing further standardisation into how the market operates in four key areas: terminology, investment descriptions and data, risk scoring, and operations including technology.

This is important because the technical and necessarily detailed nature of financial data as it relates to illiquid assets like real estate could otherwise be a barrier to entry, putting off some investors. The AREIP and its members' mission to standardise and make more easily communicable the tremendous benefits of real estate investment is therefore warmly welcomed by us at Shojin.

This transparent way of doing business is enshrined in the AREIP Code of Conduct, which members commit to following in letter and in principle. Membership of the AREIP is conditional on adhering to the Code of Conduct, and we welcome these developments as a sign that the market is rapidly maturing into a routine investment option for those unsatisfied by the current range of mainstream investments.

Consolidation is the future of this market

Like in any other market being rapidly disrupted by technological breakthroughs, online real estate investment is currently very fragmented.

There are numerous SMEs in this space, each with their own investment philosophy and target audience in mind.

This fragmentation is fantastic as a breeding ground for new ideas and innovation, and at Shojin we are proud to have been both one of the first into this new space, as well as one of the most global in terms of both investors and projects.

However, the ideas behind online fractional real estate investing are simply too good for this state of fragmentation to last too long. We expect to see a phase of consolidation start soon in which further economies of scale are accessed by the resulting larger firms, and deeper specialisation takes place as competing entities find their sub-sectors of the market in which to flourish.

In the meantime, the market will remain characterised by aspects of both competition and collaboration.