In the previous article, we talked about how important online real estate investment platforms are. By linking-up investors looking for market-beating returns on their capital with mid-market property development opportunities, savers can earn a better return, and Britain can get more desperately needed new homes.

In this article we will go into a bit more detail on exactly how the UK’s housing market is broken, and why boosting the number of mid-market developments is a key part of fixing it.

Why is the UK housing market broken?

This question has been debated back and forth between economists, investment professionals, journalists, and homeowners themselves for as long as anyone can remember. Whilst the details and specific interrelations between factors are argued over, the key fact on which there is broad consensus is that we simply don’t build enough new homes.

This has meant that as the demand for houses has risen over time, the supply hasn’t expanded at a fast enough rate to keep price increases under control. This steady increase in demand is a natural phenomenon powered by factors like increase in population size and increase in GDP per capita. In fact, each year around 500,000 students graduate from University, with many wanting to join the housing ladder.

Taken together, these essentially mean year on year there are both more people out there who want a home, and these people are on average getting richer as the economy grows and wages rise, therefore meaning they are more likely to be in a financial position where they can buy their own home.

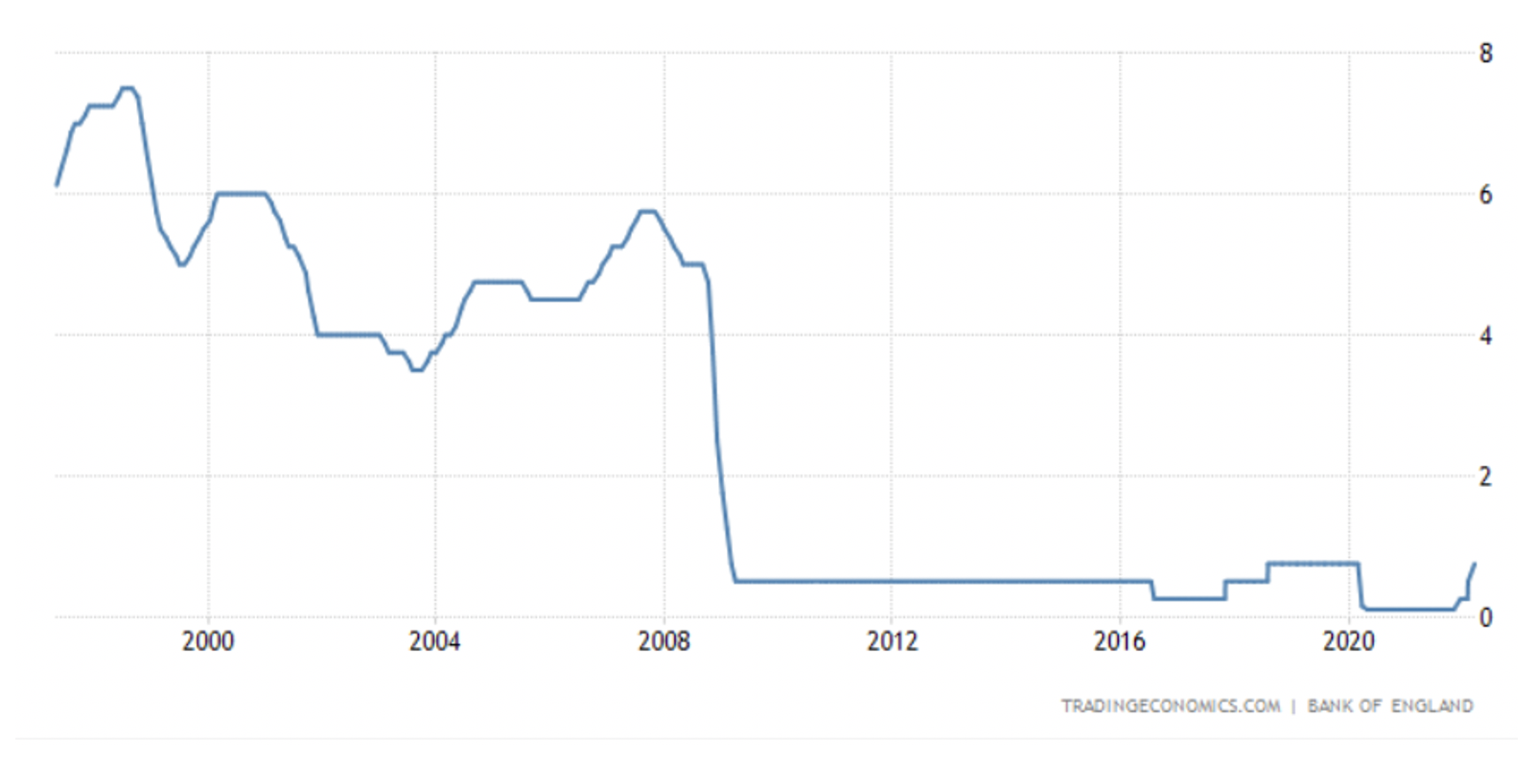

The final factor that needs to be mentioned is the extremely low interest rates seen in the UK and across the developed economies for over 10 years now. These have reduced the cost of mortgages to historically new lows, further boosting demand and expanding the gap between supply and demand. Rates are now starting to slowly move in the other direction, but still remain well below where there had been prior to 2008.

As can be seen in the chart below sourced from Trading Economics, the recent hikes in the base rate are piecemeal and paltry in comparison to where rates sat before 2008. So far, these increases have done little to dampen demand.

In fact, it can often seem as though nothing can derail the overheated UK housing market. Despite fears that the pandemic might result in a house price dip, UK average house prices actually increased by 10.2% over the year to October 2021, according to the Office for National Statistics (ONS).

Why don’t we build enough?

Given the strong and rising demand for homes in the UK then, the obvious solution is therefore to raise the scale of house building. However, for numerous reasons this has not yet happened.

Here we will focus on one key reason that is holding back house building in the UK, partly because it links directly to our area of expertise here at Shojin, and partly because it is one of the least well-understood factors at play.

We often hear about the skills shortage in the UK construction industry and how Brexit has exacerbated this pre-existing problem. By making it harder for trained construction workers from the continent to relocate to the UK, the fact that we simply don’t train enough British youngsters to work in this industry has become even more apparent.

A related but far more central issue is the lack of small and medium-sized development companies in the UK market today. This has left the delivery of housing concentrated in the hands of a few giant corporate players, with several negative knock-on consequences.

What is ‘land banking’?

Large developers sometimes have a tenancy to ‘land bank’. This means they buy a plot of land, apply for planning permission, but then leave the land untouched, potentially for many years.

This phenomenon is partly due to the skills shortage outlined above meaning even large developers probably don’t have enough workers to fulfil all of their planned projects at any point in time. Sometimes it could also be due to the fact that by buying the land but not building on it, the land is effectively taken out of circulation, thus driving up the price of other real estate in the area.

Either way, this is clearly not the most efficient way for land to be allocated to real estate projects and raises costs for smaller and medium-sized developers who could only justify the outlay of capital to buy a plot with the intention of developing it immediately.

As mentioned in a previous article, what we call the

‘middle market developer gap’ caused by the concentration of the industry has led to banks becoming more and more reluctant to lend to smaller firms, and many viable and socially-desirable projects have gone unfunded as a result.

Recent research conducted by property developer

Stripe Homes has actually uncovered that Britain’s biggest housebuilders currently own undeveloped land plots which would be sufficient to build over 440,000 new houses.

Funding the local projects that currently go unfunded

By channelling funding to mid-market developers, Shojin’s online real estate platform can help to fill the gap.

These are precisely the projects that might be too small for FTSE 100 listed builders like Barratt, Berkeley, Persimmon, and Taylor Wimpey, but which are none-the-less needed by local communities and highly profitable for their backers.

We will talk more about some specific examples in upcoming articles, but our analysis has revealed numerous sub-categories of the housing market where this gap is especially pressing.

And, as with all investments, it is such ‘sweet spots’ where essential needs are going unmet that a high return on investment is possible, in this case whilst simultaneously helping to provide more homes for the next generation.

Investor Masterclass

Sign-up now