‘Build back better’, the government policy paper outlining how the UK economy can get back on track after the disrupted years of the pandemic, rightly talks in detail about the importance of skills and innovation.

An equally crucial part of the jigsaw – and something that successive governments of both parties have struggled to make significant progress on – is the dire need to fix Britain’s broken housing market. The topics we will talk about this month therefore all relate to the fundamental importance of the housing market, the problems we face in the UK today, and how innovation can offer solutions.

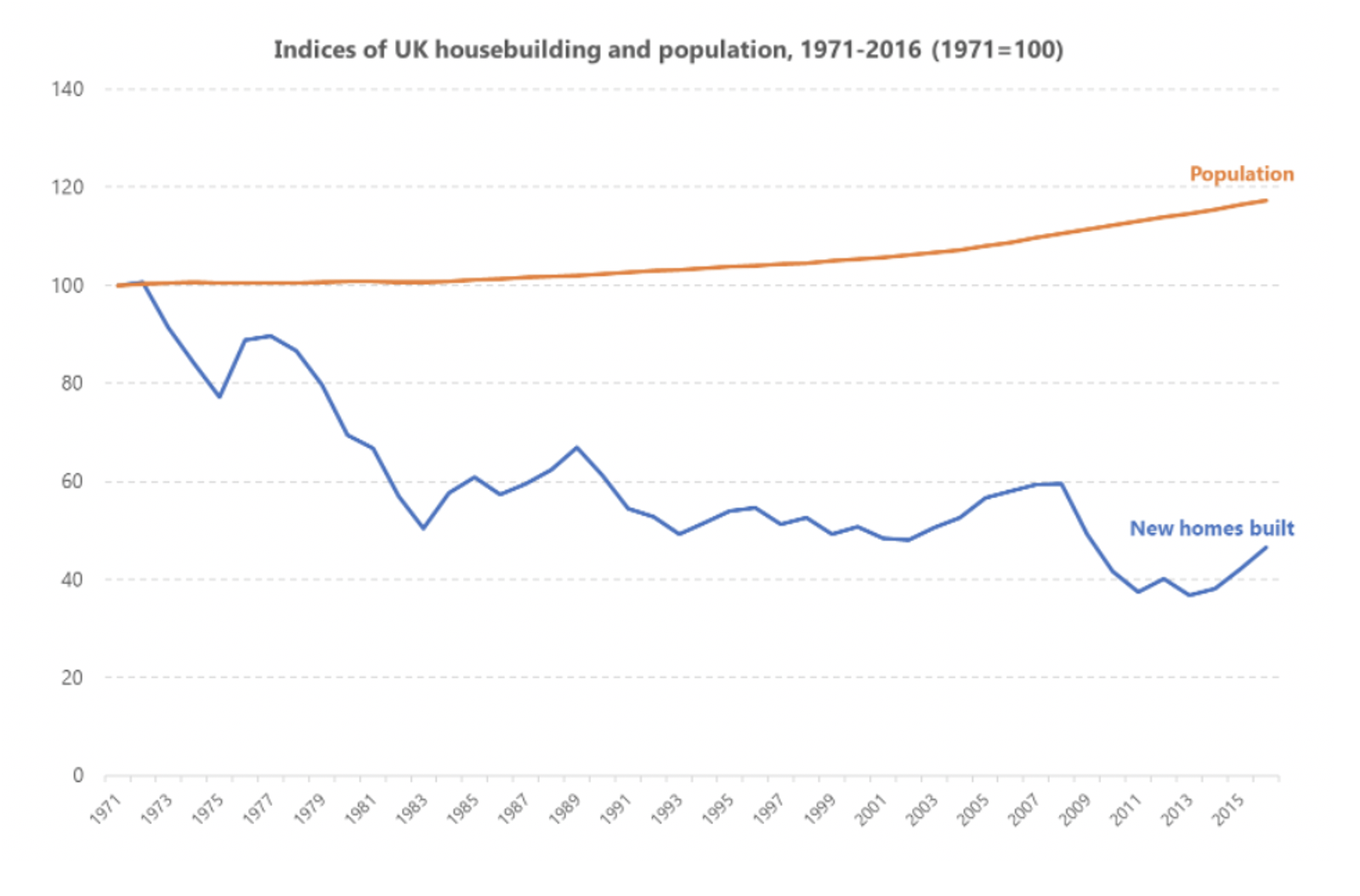

First and foremost, as the chart below sourced from Growth Capital Ventures makes clear, there is in the UK today a dire need for more house building.

As such, it is certainly welcome that the government has unveiled plans to invest in what it terms the National Home Building Fund (NHBF). With upfront funding of around £7.1 billion and a mission to unlock up to 860,000 new homes in the next few years, the NHBF should at least go some way towards reversing the UK’s chronic housing shortage.

As such, it is certainly welcome that the government has unveiled plans to invest in what it terms the National Home Building Fund (NHBF). With upfront funding of around £7.1 billion and a mission to unlock up to 860,000 new homes in the next few years, the NHBF should at least go some way towards reversing the UK’s chronic housing shortage. However, this action alone is far from sufficient, and there is still a great deal of room for private sector actors to do more in this space.

This first of a series of articles will explain some of the reasons why new entrants to the property funding marketplace are so important for repairing the health of this sector.

Agile property investment firms like Shojin are ready and able to contribute to solving this national crisis through our unique ability to combine cutting-edge technology with traditional asset management expertise.

What is ‘proptech’ and why does it matter?

Proptech, or property technology, is a broad phrase designed to capture the rapid rates of innovation and modernisation underway in the real estate sector. The application of advanced technology to the fundamentally traditional property sector has already yielded huge benefits for both customers and firms, and the journey has really only just begun.

Essentially, proptech means harnessing the power of innovation to make everything to do with buying, owning, leasing, living, or working in a building simpler, easier, and more efficient.

In our case here at Shojin, the proptech component of our investment proposition is primarily our use of technology to facilitate peer-to-peer lending. This peer-to-peer lending carried out through our online investment portal can provide an inflation-beating income to investors through a structured repayment schedule set out in advance, or through capital appreciation, depending on the product purchased.

Peer-to-peer lending involves loaning capital to borrowers, in this case developers seeking to finance a property deal. The original capital is repaid at the completion of the project, in addition to a fixed rate of interest throughout the duration.

More homes built is a win for everyone

Investment products such as those offered by Shojin and other online real estate investment platforms can therefore help to provide a modern, diversified portfolio of income-yielding investments. In addition, real estate investments made through peer-to-peer lending platforms have the potential to generate above-market returns for investors.

This is because the profound shortage of funding to mid-market developers in the UK today, combined with the general inability of supply to keep up with demand in the housing market, means outsized returns can be made in the mid-market sector. We have already addressed this topic – what we term the ‘mid-market developer funding gap’ – in more detail in a previous article.

The good news is that competition and innovation in the world of real estate investment are already providing better outcomes for all: more homes for first-time buyers; more funding for mid-sized developers; and better returns for investors.

Shojin and other online real estate investment platforms are filling a key gap in the market. By providing funding to mid-sized developers, we are enabling them to go ahead and build the homes the next generation so badly needs.

Because we were early to identify the needs of this underfunded sector, we are seeing outsized returns on our investments whilst helping to solve the national crisis represented by the chronic under-provision of new homes.

What makes Shojin stand out?

Online real estate investment platforms like Shojin can effectively leverage a unique combination of strengths to benefit all stakeholders in this space.

Firstly, we have the necessary experience and expertise in property investment required to identify the most lucrative and reliable projects. Specifically, we specialise in the so-called mid-market developments mentioned above where the mismatch between supply and demand is particularly acute. This means the expected returns are well above average, and we’re passionate about bringing these returns to ordinary investors previously locked out of such opportunities.

Secondly, we have mastered the financial techniques required to make fractional ownership work for the average investor and on their budget. Fractionalisation of our mid-sized real estate investment projects means that anyone can participate, whether they have £5,000, £500,000, or £5 million to invest. This is only possible because we have been swift to take advantage of the technological breakthroughs of recent years and have welcomed the disruption technology has brought to the previously closed real estate investment world.

Thirdly, we are very proud of our pioneering co-investment model, through which we always invest our own capital in every project we propose to our investors. This means that we have ‘skin in the game’, and are not merely salesmen pitching other people’s projects to our clients and then washing our hands of the results.

Finally, we make our returns in the same way as our investors do, based on profits that are shared at the completion of the project. We only take our share of the profits after external investors have been paid, and in the event of a project returning a loss, that loss is primarily borne by Shojin. We believe that this is the way investing should work with all interests perfectly aligned.