The multitude of options an investor faces can cause indecision and inaction.

Should you put your money into an actively managed fund, or take a more passive index-tracking approach? How should you split your savings between different asset types, and which assets should you include in the first place? What does a well-diversified portfolio look like in 2022? How much risk are you willing to take, and over what kind of timeframe?

In the process of researching different investment opportunities, the questions to be answered can seem to multiply so continually that every new piece of information received simply leads to yet more questions, and making a final decision becomes harder and harder. This well-known phenomenon has a name – analysis paralysis – and we have all suffered from it regarding our personal finances at one point or another.

This article proposes two simple steps that can be taken to overcome analysis paralysis.

Time in the market, or timing the market?

The first way to exit the stalemate of analysis paralysis is to realise that the sooner your investment journey starts, the sooner you can enjoy the benefits!

A well-known financial adage says that success in the investing game is all about time in the market, rather than timing the market. This is because whilst there will always be the temptation to try and make an overnight killing by moving your money in and out of the stock market to benefit from peaks and dips in valuations, this is universally acknowledged to be a high-risk strategy with a very, very low probability of success.

This is because the amount of data that is available and would need to be analysed and evaluated to allow consistently correct short-term trading decisions to be made is simply too vast to process.

As such, the first way to break the deadlock and overcome analysis paralysis is to realise that time spent procrastinating and endlessly analysing is ultimately time when your money isn’t out there being put to work for you.

You are almost always going to be better-off deciding to commit to an investment and then waiting and letting your wealth grow over time.

Should I just give my money to a hedge fund?

Importantly, information overload and the analysis paralysis that it leads to is just as much of a problem for hedge funds and institutional investors as it is for individuals managing their own money. The point is that no one can be right every time about each short-term investment decision, but everyone has a fair chance of being right about a few long-term investment choices.

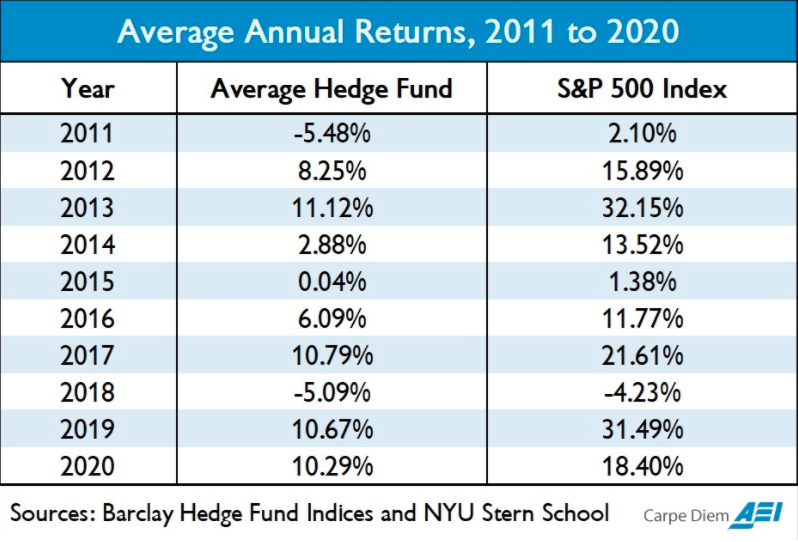

As the table below shows, time and time again evidence points to the fact that the vast majority of hedge funds simply don’t outperform the benchmark indexes they claim to offer superior returns in comparison to.

Table sourced from: https://www.aei.org/carpe-diem/the-sp-500-index-out-performed-hedge-funds-over-the-last-10-years-and...

If you were given the choice of what year from the table above, you’d most like to have put your money into the S&P 500, there would be no reason to say any year other than 2011. And, you might well add, ideally your money would have been invested even sooner, because the pattern shown in the table of consistent, if fluctuating, gains is far from unique to this decade!

Recognising that hedge funds are in the long term extremely unlikely to beat the market, and it is the time pasted from the inception of an investment that is often the main driver of growth, are key steps to overcoming analysis paralysis and starting to take ownership over your own financial planning.

The next question to answer is what type of assets you would like to include in your portfolio.

What is a ‘timeless’ investment asset?

The second step to avoid analysis paralysis is to choose to focus on ‘timeless’ asset types. By this we mean assets that will never look out of place in a sensible, diversified portfolio because they have a sound basis in economic reality.

Because some asset types never go out of fashion, there are some investment opportunities which your future self will thank you for entering as early as possible! Tracker funds following major global indices like the S&P 500 would be an example of an equity investments that can be bought once and held for many years.

Why is real estate also a ‘timeless’ asset?

Real estate is normally considered as an investment option only open to large investors due to its capital-intensive nature. However, recent innovations have broken down this barrier to entry and for the first time made it possible for private investors to benefit from exposure to this uniquely beneficial asset class. Real estate investments are so appealing to large-scale investors because they are low-risk, stable, income-yielding, and offer capital growth as well as capital preservation.

Properties generate monthly or quarterly rental income for their owners, and this provides a reliable stream of cash that can expected to increase ahead of inflation. This is because tenancy contract rises are linked to inflation, and therefore their value rises at least in line with inflation. This income usually provides a 3-5% annual yield to investors and is therefore a generally better source of income than equities.

From a portfolio perspective, the inclusion of real estate can help achieve diversification whilst also hedging a portfolio against economic downturns. It is important that the performance of real estate tends not to closely correlate to equities and other securities. For example, in a recession the stock market and hedge funds will decline, but owners of office or residential properties will most likely continue to receive rental income.

The variety of projects available within the overall category of real estate allows further diversification. Real estate investments are available to suit any taste or investment style, from office blocks to logistics parks, shopping centres or student housing, and all available across multiple locations both within the UK and internationally.

Stop procrastinating – start investing

To summarise, analysis paralysis affects all of us – especially when making decisions about our own money. There are two key steps to getting past this obstacle which is preventing you from taking control of your personal finances and seeing your money grow over time.

Firstly, recognise that time in the market is the main driver of growth in capital values, so start investing as early as you can. And secondly, whilst there are a bewildering array of assets and strategies to choose from, real estate will virtually never be a bad investment.

Become an enlightened property investor

Shojin is an FCA regulated online investment platform enabling global investors to access lucrative institutional-grade investments in the real estate sector on a fractional basis. We specialise in debt and equity investments in middle-market real estate development projects in the UK and our investors come from over 40 countries. Shojin carries out all due diligence, invests its own capital into projects and oversees the projects from start to end, sharing profits rather than raking large upfront fees. This creates the perfect alignment of interest and is a vast improvement on traditional equity investment models.